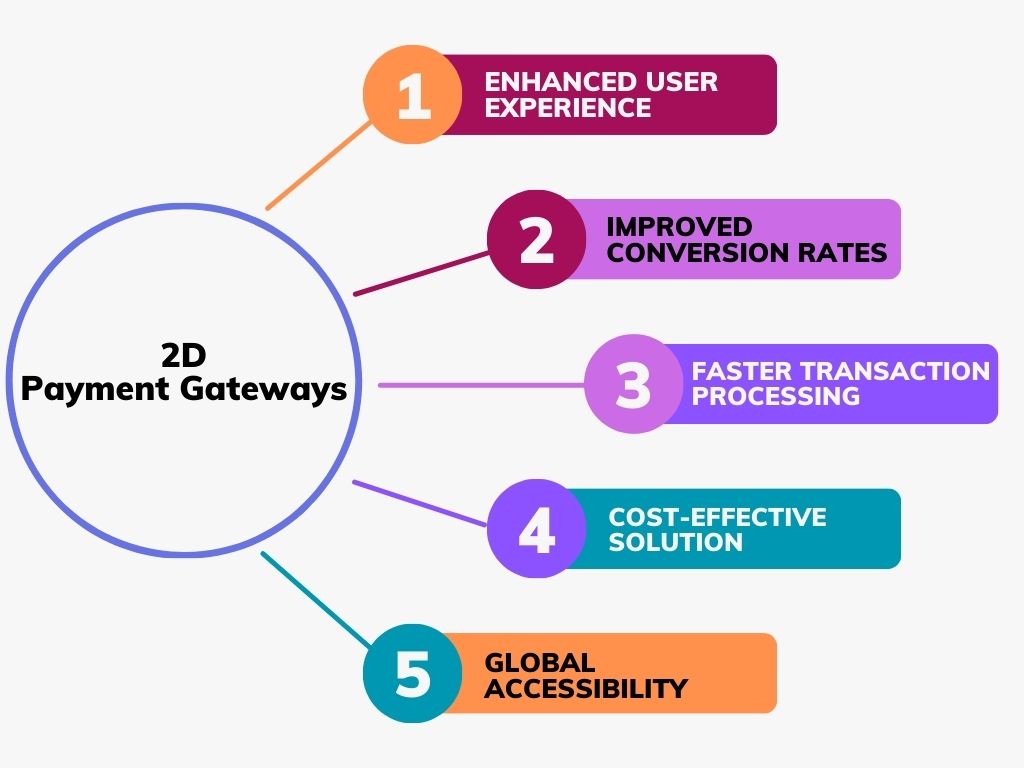

Just How a 2D Payment Gateway Boosts Safety And Security and Effectiveness in Ecommerce

Discovering the Conveniences and Characteristics of a Versatile Settlement Gateway for Seamless Transactions

In today's digital economic situation, the choice of a repayment gateway can dramatically influence the client experience and overall company success. A versatile repayment gateway not only offers improved safety and security features to secure delicate information but likewise offers multiple settlement choices tailored to diverse consumer needs.

Enhanced Safety Features

In the digital age, improved safety functions are extremely important for repayment portals, making sure the security of delicate economic information. As on-line transactions multiply, the risk of information violations and fraud increases, making robust safety and security procedures vital for both services and consumers. Payment portals use numerous layers of security procedures, consisting of file encryption, tokenization, and secure outlet layer (SSL) technology, to protect deal data during processing.

Security converts delicate info right into unreadable code, protecting against unapproved accessibility during transmission. Tokenization additionally enhances protection by replacing sensitive data with distinct identification symbols or symbols, which can be made use of for processing without revealing the initial information. In addition, SSL certificates establish safe and secure connections between the user's web browser and the web server, ensuring that data traded remains private.

Moreover, conformity with industry requirements such as the Payment Card Market Data Protection Requirement (PCI DSS) is essential for settlement gateways. Adhering to these requirements not only aids secure versus safety susceptabilities yet likewise cultivates depend on among customers. Ultimately, the execution of sophisticated safety attributes within settlement entrances is vital for preserving the integrity of economic transactions and making certain a risk-free on the internet shopping experience.

Multiple Payment Choices

Providing several repayment alternatives is important for suiting varied client choices and boosting the overall shopping experience. A functional settlement gateway enables businesses to incorporate various repayment methods, including credit report and debit cards, electronic purses, financial institution transfers, and also cryptocurrencies. This adaptability not only accommodates a larger target market but also raises customer contentment and commitment.

In enhancement to accommodating customer choices, a durable payment gateway can improve the deal process, permitting quicker check outs and minimizing friction during the repayment phase. This performance is vital in today's hectic e-commerce environment, where customers expect smooth purchases.

Eventually, using a range of settlement options not only boosts customer experience however also positions businesses to continue to be competitive in a rapidly progressing electronic landscape. Accepting this convenience is a strategic step that can produce considerable rois.

User-Friendly User Interface

A reliable interface incorporates clear navigation, aesthetically attractive layout, and quickly well-known switches. These aspects guide individuals flawlessly with the settlement process, reducing the threat of abandonment. Additionally, the interface should supply real-time responses, such as verification messages or error informs, which notifies customers of their purchase standing and reassures them that their sensitive info is safe.

Furthermore, a straightforward settlement entrance suits numerous user choices, such as language alternatives and accessibility features. This inclusivity not only expands the client base however also boosts total individual complete satisfaction - 2D Payment Gateway. By focusing on an easy to use interface, companies can promote trust and commitment, eventually resulting in enhanced my website revenue and long-term success

Combination Capacities

Reliable assimilation capabilities are necessary for any type of settlement gateway, as they establish just how effortlessly the system can get in touch with existing company applications and systems. A flexible repayment gateway must support numerous assimilation approaches, consisting of APIs, SDKs, and plugins, which enable services to include settlement processing into their internet sites, mobile applications, and ecommerce platforms with marginal disturbance.

Robust combination choices make it possible for organizations to leverage their existing facilities while enhancing functionality. The ability to incorporate with popular shopping systems such as Shopify, WooCommerce, and Magento is especially useful, as it simplifies the repayment procedure for consumers and merchants alike. Additionally, look at here now compatibility with client relationship monitoring (CRM) systems and enterprise source planning (ERP) software streamlines procedures, promoting better data monitoring and reporting.

Moreover, a settlement entrance that sustains numerous programming languages and frameworks uses services the flexibility to personalize the integration according to their one-of-a-kind requirements. This adaptability not only improves user experience but likewise enables for quicker modifications and updates, making certain that companies can reply to developing market needs efficiently. Inevitably, strong combination capacities are vital for companies looking for to enhance their payment processes and enhance total operational efficiency.

Improved Purchase Speed

Smooth integration capabilities prepared for accomplishing improved transaction speed within a repayment portal. By making sure compatibility with numerous ecommerce systems and systems, organizations can help with fast and efficient payment handling. This structured combination minimizes the moment required to complete transactions, inevitably boosting the customer experience.

One more significant facet of boosted transaction rate is the decrease of manual treatment. Automated processes minimize human error and my latest blog post quicken the confirmation and permission phases, allowing for immediate approvals - 2D Payment Gateway. Furthermore, making use of robust APIs enables smooth interaction between various systems, additionally boosting purchase efficiency

Final Thought

In verdict, a functional payment gateway dramatically boosts deal procedures via its durable security features, varied settlement options, and instinctive user interface. The significance of selecting an effective settlement entrance can not be overstated, as it plays a crucial duty in the success of online purchases.

A versatile repayment portal not just provides boosted security functions to protect delicate data but additionally provides several settlement choices customized to diverse consumer demands.Moreover, conformity with sector criteria such as the Repayment Card Market Data Safety Standard (PCI DSS) is critical for repayment gateways. A functional payment gateway enables companies to integrate various repayment techniques, including credit scores and debit cards, digital wallets, bank transfers, and even cryptocurrencies. When customers run into a settlement entrance that is simple and intuitive, they are extra likely to complete their purchases without aggravation.In final thought, a versatile settlement entrance dramatically boosts purchase processes via its durable safety and security attributes, diverse repayment choices, and instinctive user interface.